Flat tax

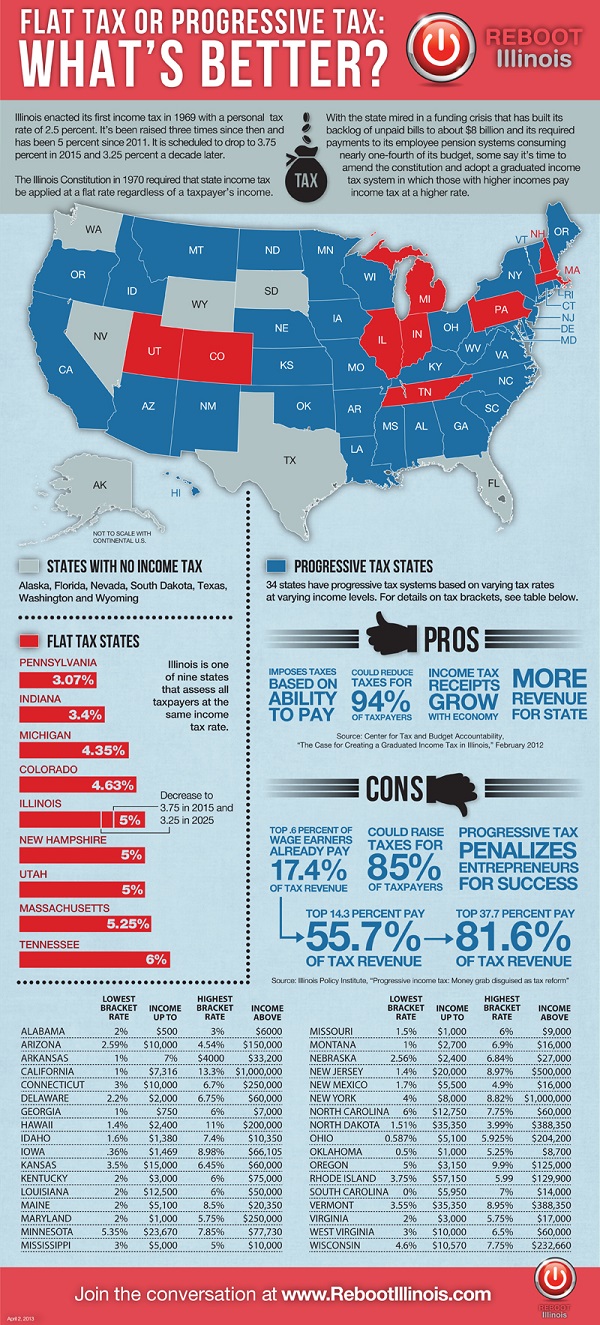

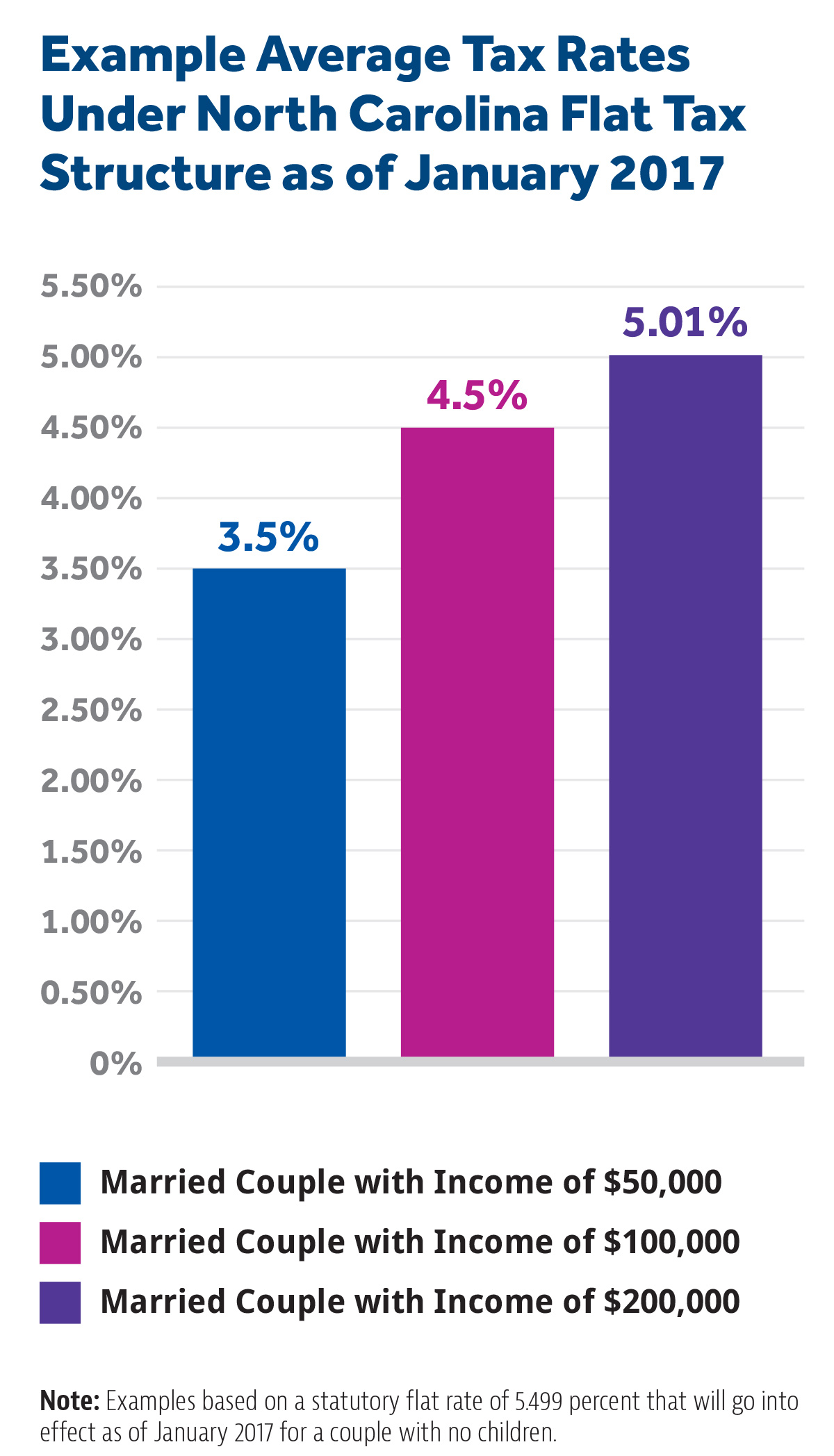

Web Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. Web An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets.

The Case For Flat Taxes The Economist

And a flat tax could also give middle-class families.

. Properties having a variation with tax assessed being 10 or more over the representative median. Web Cosè la Flat tax. Web A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base.

A flat tax is levied on income-but only. It is a system that has been proven to work at a national level. Web After that a comparison of those properties tax billing amounts is completed.

In Hungary a progressive taxation system. However the US government has. For example a family of four would.

La Flat Tax aussi appelée Prélèvement Forfaitaire. Some states add a flat. It is not necessarily a.

Web Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron. For example a tax rate of 10 would mean that an individual earning. Web The flat tax system would also eliminate the estate tax Obamacare taxes as well as the Alternative Minimum Tax.

Web In this respect a flat tax is a type of consumption tax. A flat tax is a taxation system whereby a uniform tax rate applies to all taxpayers irrespective of their income. Web In the United States payroll taxes are considered flat tax as all taxpayers are required to pay payroll tax at the same tax rate of 153 in total.

The rates are now being viewed in effect as a flat tax rate. Premium LISTING PLAN - Standard. Di seguito cercheremo di capire con un esempio pratico come funziona o meglio potrebbe funzionare la flat tax.

Web A flat tax would eliminate this penalty for those who are self-employed. Such a tax usually doesnt provide any deduction. The difference between a flat tax and a national sales tax is where the tax is collected.

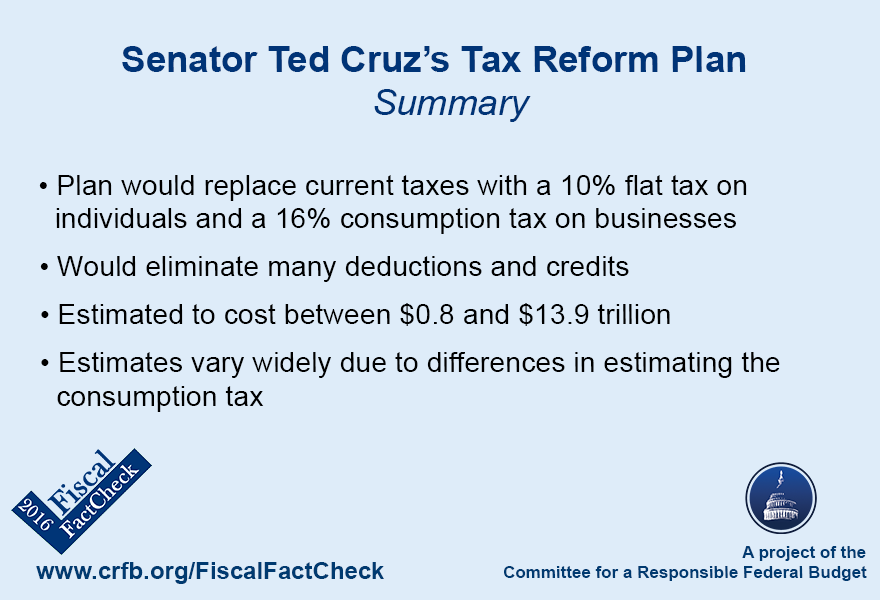

This new and updated edition of The Flat Tax sets forth the flat-tax plan developed by Robert Hall and Alvin Rabushka senior fellows at the Hoover Institution. The tax proposal would also reduce corporate taxes to 16. Residents of Wilmington pay a flat city income tax of 125 on earned income in addition to the Delaware income tax and the Federal income tax.

Web Flat Tax Definition. Flat taxes are when everyone pays the same amount regardless of income. Web Flat Fee MLS Listing National and Local REALTOR MLS 610-572-7347 See Listing Plans Below.

Flat taxes are typically a flat rate rather than a flat dollar amount. Web The idea is simple. Alcuni esempi pratici per capire come funziona.

Therefore except for the. We would junk our horrid code and replace it with a single tax rate along with generous exemptions for adults and children. Web Flat tax is a system that applies the same tax rate to every taxpayer regardless of income bracket.

Technically the tax code contains different tax rates. Typically a flat tax applies the same tax rate to all taxpayers with no. Web A gradual tax system does allow for things like wealth redistribution which many have argued is a major benefit to society.

Web In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. Web The Flat Tax. Web In 2018 the top federal estate gift and GST tax rates are 40.

Chris Carr Contact Us.

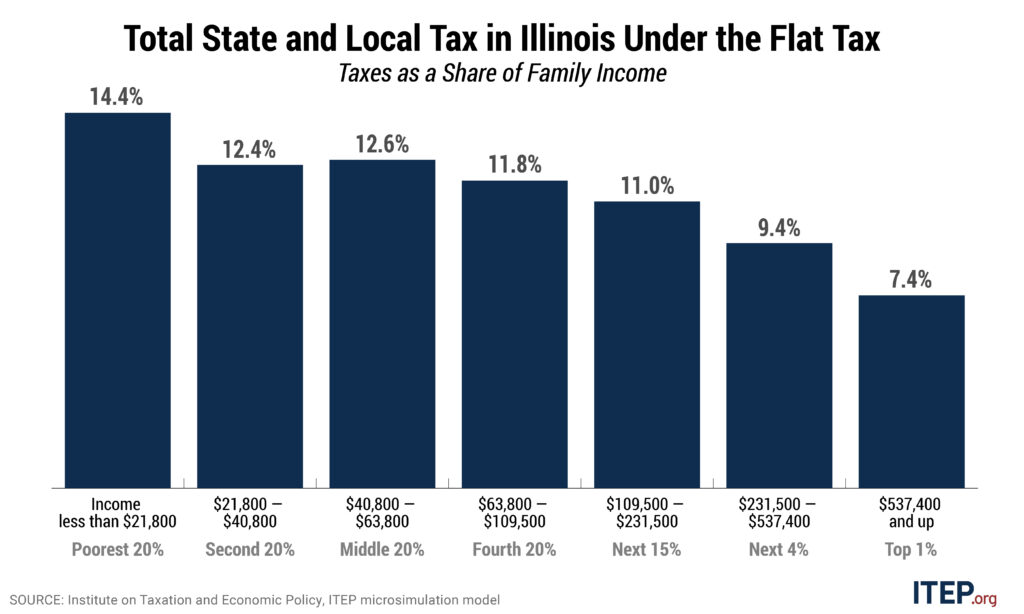

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Progressive Tax Vs Flat Tax By Karen Hamilton

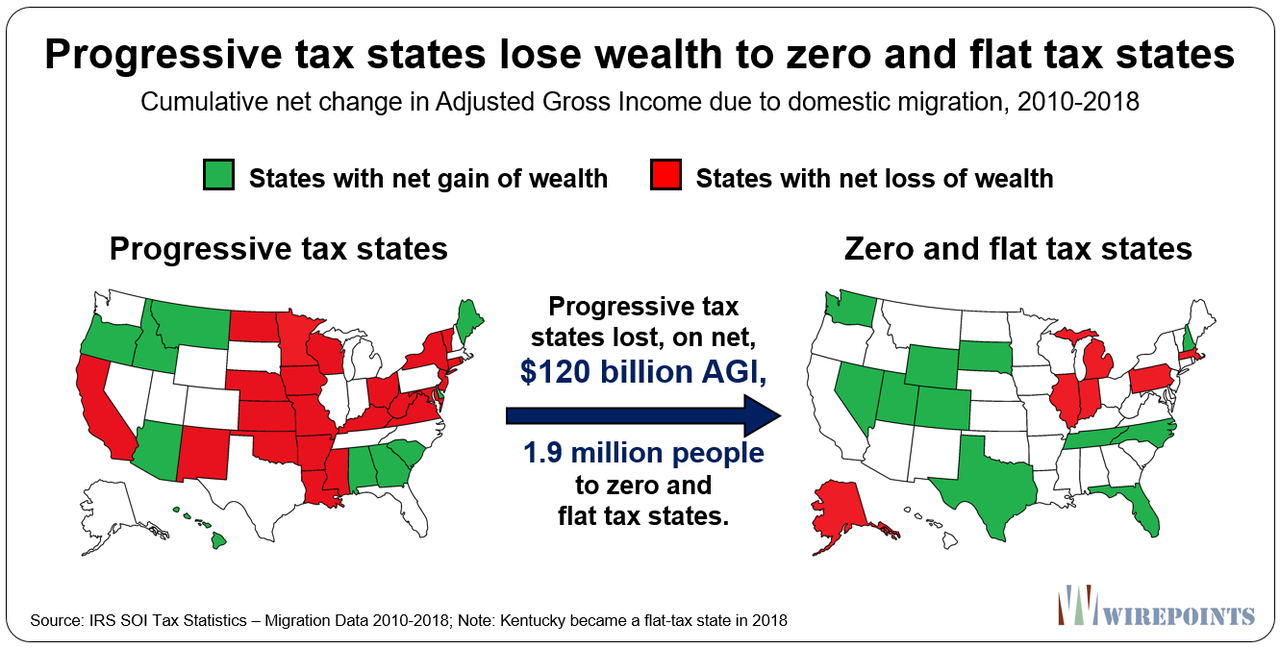

Tax Migration Everchem Specialty Chemicals

The Flat Tax Hoover Institution The Flat Tax

An Axiomatic Case For The Flat Tax Thinkmarkets

Senator Ted Cruz S Tax Reform Plan Committee For A Responsible Federal Budget

Flat Income Tax Progressive Tax No State Income Tax A Nationwide Overview Huffpost Chicago

The Flat Tax Falls Flat For Good Reasons The Washington Post

Progressivity And The Flat Tax

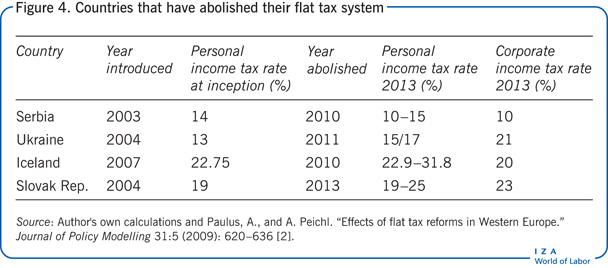

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

The Fairly Flat Tax Burden In 2011 Matt Bruenig Dot Com

The Grumpy Economist Tax Graph

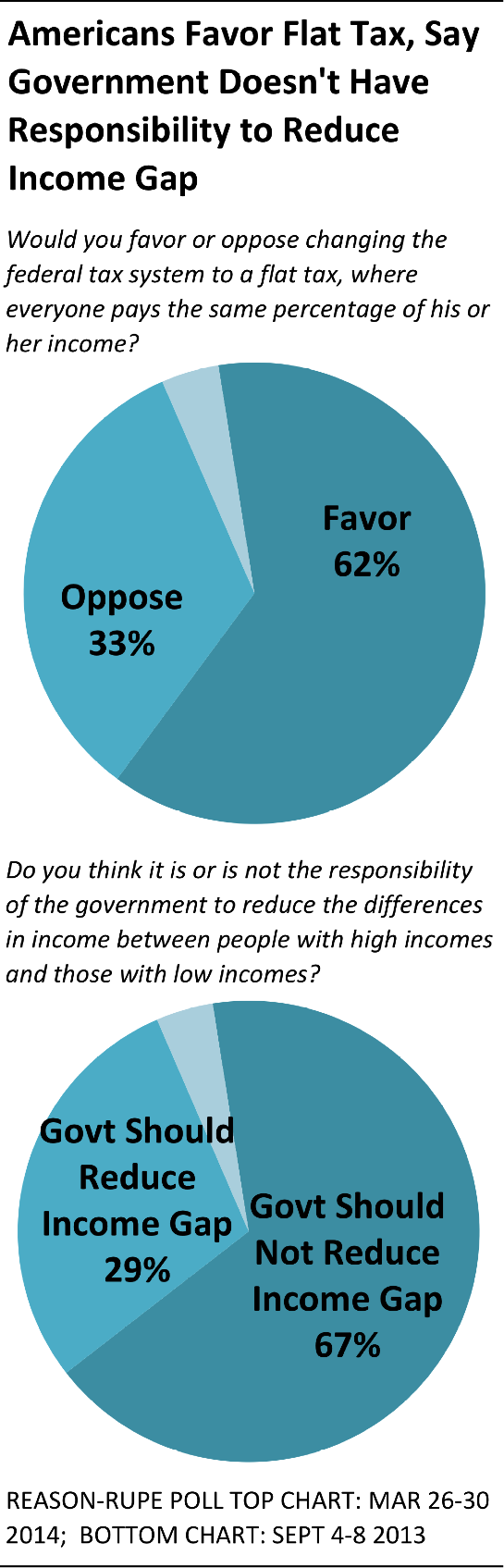

Most Republicans Back A Flat Tax Yougov

Reasons Flat Tax Isn T A Good Idea Leo Titone S Views On Tax Issues

1 Flat Tax Revolution In Europe Country Introduction Of Flat Tax Income Download Table

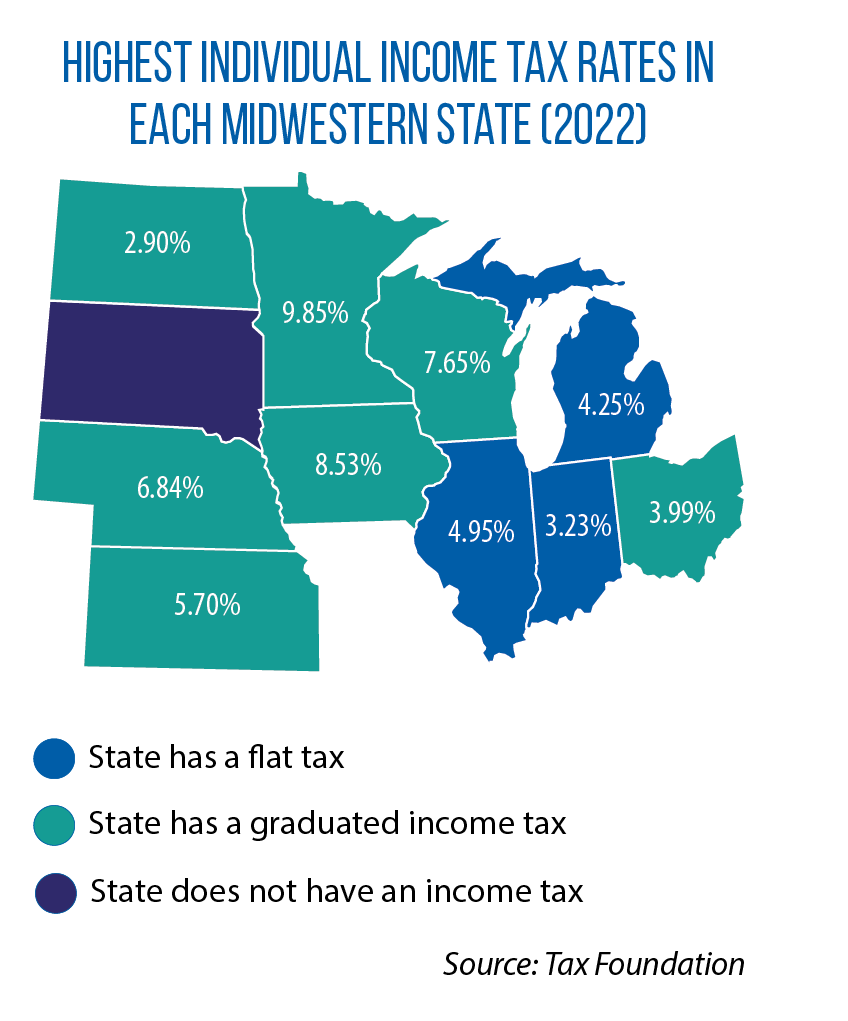

Iowa Switching To Flat Income Tax System Joining Three Other States In Midwest Csg Midwest Csg Midwest

Illinois Issues Flat Vs Graduated Income Tax Illinois Public Media News Illinois Public Media